Every month my husband and I go over our budget for the next month. Once we decide where our money will go, I handle the execution part of the finances. I am a nerd at heart and love a good spreadsheet…I literally make spreadsheets about what spreadsheets I need to make. So, when it came to budgeting it’s no different.

The monthly budget spreadsheet

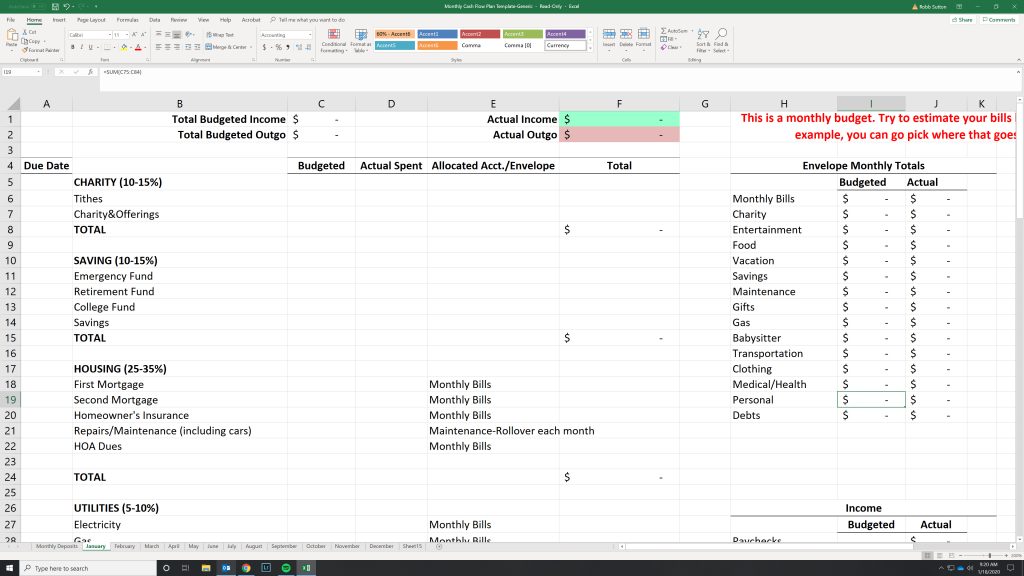

As I was searching for the perfect budget spreadsheet, I couldn’t find one that had everything I wanted. I wanted to know about how much we should be spending in each category and an exhaustive list of what should be included in my budget so I didn’t forget anything. After thorough searching, I combined a few different budgets I found to create one that works for me. I’ve been using this spreadsheet and system for about four years now.

How I use the monthly budget spreadsheet

Before the month starts, I go through and calculate what our income will be for the next month. My husband is in sales, so it’s not always the same. Next, I go down the budget column and put all the bills I know are coming that don’t change, i.e., Mortgage, car payment, car insurance, daycare etc. For utilities, I estimate based on the same month from the previous year. If you’re just starting out, use the previous month to estimate. After the necessities, I determine how much we will spend on food and gas, etc. The spreadsheet will keep a tally of everything as you work through it, so you will see how much you have left to allocate to debt, memberships, clothes, and anything else listed in the budget.

Within the title of each category, I have put the recommended percentage of your income that should be allocated for that category. This helped us determine if we were allocating too much in one area when we were first learning to budget. I have also added which envelope I am putting the money; I use virtual envelopes, so this helps me figure out where to put the money. I also added an overview of important envelopes to us on the right so we could see at a glance what was budgeted and what was spent. This was also great for my husband who doesn’t like all the small details. He just wants to know what we planned and how we did against our plan.

Now for the fun (Or at least I think so)!

Throughout the month, enter what you spend in the “Actual” column. This column is color coded to let you know how your doing at a glance. If you stay at or under budget for bills, the cell is green. If you go over, the cell turns red. For debt it is the opposite. If you pay less than planned, it is red and if you pay more than planned, it turns green. When tracking, I normally use a formula (i.e. =21.50+42.82) in each “Actual” cell to tally the total for me.

How to save the budget spreadsheet for planning

Like I said before, I have been using this system for about four years and it has worked great for us. One of the things I have found that has made this easier is saving the file with the year. So next year I can look back and estimate our utilities better and can see when yearly bills are coming, like HOA fees, in order to plan better. As I used this more, I found that it was easier for me to plan how much was coming out of each paycheck and going into each envelope before the month started. To keep track of this, I created a separate tab called “Monthly Deposits” where I can plan where my money goes and track when I put it there.

I hope this helps you guys get your finances organized this year!! What budgeting secrets to you have? What are some of your money goals this year?

Download the free budget template by entering your email below.

Your free monthly budget excel spreadsheet will be delivered straight to your inbox!